The Bottom Line Easy Forex

Vital Trading Information About Easy Forex

The foreign exchange trading platform can often be confusing to new users. Easy Forex provides an uncomplicated user-friendly FX trading program that helps new users to gracefully enter the world foreign exchange currency trading. Beginners can practice with the Easy Forex Trade Simulator program that allows these new users a no-risk, no-cost way of becoming familiar with the current trading procedures and guidelines. This trade simulator is also extensively used by the FX professionals who are experimenting with enhanced trading strategies.

Minimum Deposit Amounts:

Setting up an account with the Easy Forex system requires about 5 minutes of time. The sign-up process is done with a convenient 3-step process that is easy for all new users to follow. At the online EasyForex.com site, the minimum deposit scale begins at only $200 dollars. Tailor-made extra-large deposits are also accommodated on this currency trading Website. An account service manager is available to communicate with the traders who would like to discuss the current trends or options that may help in maximizing a trading investment experience.

Account Set-Up:

Setting up an account with the Easy Forex system requires about 5 minutes of time. The sign-up process is done with a convenient 3-step process that is easy for all new users to follow. At the online EasyForex.com site, the minimum deposit scale begins at only $200 dollars. Tailor-made extra-large deposits are also accommodated on this currency trading Website. An account service manager is available to communicate with the traders who would like to discuss the current trends or options that may help in maximizing a trading investment experience.

Demonstration Account:

When a trader registers online at EasyForex.com, they can take advantage of a very useful demonstration program that will issue a practice account with $50,000 virtual dollars in it to experiment with. Through the use of news feeds and play updates, the new user can practice the FX trading formats until they feel comfortable with the trading systems.

The Easy Forex online Internet site is multilingual. Forex traders can choose their favorite display language from: Arabic, Chinese, English, French, German, Greek, Hebrew, Polish, Russian, Spanish.

Leverage Limits, Trading Spreads, and Trailing Stops:

At Easy Forex, users can leverage their trading for as low as 1:100. Big trading options can happen with small investments on the EasyForex.com trading site. Leverage ratio choices can be 1:50, 1:100, 1:200, or a higher ratio in some of the specialized accounts. United States users are regulated by the National Futures Association (NFA) that caps the leverage ratio at 1:100 for all FX trading that is done in this country. The Easy Forex spreads are low across the board, and normally range from 3 to 5 pips to allow traders from all countries a reasonable profit margin.

Spreads at Easy Forex are set at a moderate level and they vary between accounts, and according to calendar schedules. After-hours trading or foreign currency trading during peak trading conditions may fall under higher spread rates. Highly advanced systems and software programs are in place to ensure that each trade is executed at the user settings for stop-loss and take-profit rates. EasyForex.com allows traders to pre-set trading rates, or to modify trading rates, to a predetermined time or date. The trader may also modify the system settings while the deal is open.

Customer Service and Secure Service Options at Easy Forex:

Easy Forex does make use of a dealing desk.

Dedicated personalized services are available through the Easy Forex.com FX site. Personal account managers are available to all users regardless of account size, at all hours of the day or night. The customer support service functions through a real-time online chat box that is easy for all users to operate.

Short Message Servicing (SMS) functions can also deliver mobile phone updates to account holders from the trading marketplace. Mobile phone alerts can include rate alerts, deal closure alerts, and limit order capture alerts. This innovative SMS feature from Easy Forex set the mobile alert standards for the rest of the FX trading industry.

Another first at Easy Forex is the instant trading program that allows direct credit card use at all hours of the day or night. A state-of-the-art double layered firewall security system is coupled with a practiced authentication standards program to provide a safe credit card format. Users can use their credit cards online through this program and be assured that their privacy is safeguarded while trading through the Easy Forex site.

Beginners can utilize the personal account service manager training session that will walk first-time traders through a live step-by-step trading session. There are some elaborate and resourceful training options that include the step-by-step trading session, a guided tour, FX e-books, and the handy free trade simulator that provides $50,000 virtual dollars to practice the Easy Forex system and all levels of foreign currency trading techniques.

All Easy Forex.com traders enjoy the highly simplified visual trade controller program. This is a precision control instrument that allows users to handle scenarios of FX trading in a very simplified manner. Every level of user can modify stop losses, check alternate scenarios, and define the current rates to set the take-profit rates easily. The Easy Forex system strives to make all levels of traders feel comfortable during transactions.

FX trading at Easy Forex does not require software downloads, or computer use from a single IP address. The entire system is a Web-based program that allows for real-time data to be displayed for the FX marketplace. Since the software is a Web-based program, foreign currency traders can access their accounts in a comprehensive manner from all methods of mobile personal technology devices that connect to the Internet.

Easy Forex

Easy Forex is the innovative forerunner FX trading system that created the industry standards for online foreign exchange currency trades and transactions. Founded in the year 2003, Easy Forex is a Website that was fashioned by a diverse group of industry professionals from the trading, banking, and Internet marketing sectors. Easy Forex is a resourceful Website that provides direct access to all important global currency markets.

While EasyForex.com was originally founded in Cypress, this foreign exchange trading platform is registered in the United States of America with the Commodities Futures Trading Commission. This Forex brokerage firm is also a member of the prestigious commodities watchdog organization, The National Futures Association. Currently, there are over 21 highly-respected global banking institutions providing financial backing for the online Easy Forex programs.

Key Registrations:

- Commodities Futures Trading Commission (UFTC)

- National Futures Association (NFA)

- U.S. Better Business Bureau (BBB) / B+ Rating

Trading with CMC

Trading Desk

CMC uses a completely online interface in place of a trading desk. The company’s own platform, Marketmaker, is a completely online and real-time system that makes the Forex trading experience as efficient as possible. Marketmaker mobile is a more recent innovation which allows customers to manage accounts from their mobile devices. Because the entire process is electronic and automated, CMC Group is able to cut delays and decrease overhead.

Trailing Stops

They do not offer stop orders, limit orders, or trailing stops, but they do have a free demo account.

Minimum Deposits

The minimum deposit is $2,000.

Account Management and Trading Spreads

CMC allows the customer to determine their own amount of leveraging, allowing as little as £1 per point on all of their financial instruments. CMC also charges no commission or account management fees on spread betting. The company prides themselves on having some of the tightest spreads in the market. Their spreads include a huge range of commodities and international markets. They also provide very competitive margin rates, ranging from 1% to 15%.

Who can use CMC?

The company is regulated by the FSA and provides accounts to individuals or corporations. Spread betting accounts are available only to individuals in the UK and Ireland, while anyone can open a CFD account. With offices in more than a dozen countries throughout the world and translation into all of these languages, CMC provides access for many customers and also provides access to many international markets. In addition, retail partners can use CMC services as the core of their business through white-labeling. This has been a very successful part of CMC Group’s core business.

Advantages of Using CMC

Free Online Education

Another significant value is the free online education courses that CMC offers all of their customers. These range from advanced training schedules for experienced traders, to simple education for people that are new to spread betting. Anyone that registers for an account has access to this impressive library of information.

Technology

CMC’s greatest asset may be in its technology. As one of the first to provide this kind of internet trading, the company has been committed to providing cutting-edge innovation from the beginning. Marketmaker is a well-rounded suite of trading software that has won a number of prestigious awards. CMC continues to make major investments in their proprietary trading platform and mobile software, and the result will be a long-term asset for them and their customers.

Simplicity

One other intangible strength has probably contributed to making CMC successful—they have made the entire trading process intuitive and accessible to inexperienced traders. The CMC web-site is well-organized and easy for anyone to use. Their explanations and tools are simple and visually clear. They answer basic questions that the uneducated consumer would certainly ask and they provide extensive information on all of their financial products. All in all, they work to make CFDs and spread betting as unintimidating as possible.

Sophistication

But this is not at the sacrifice of advanced information for the experienced trader. In fact, CMC works to provide both simple and advanced information so that either kind of individual will benefit from their services. As yet another aspect of their technological strength, CMC offers free services to advanced traders, such as risk-management tools, research tools, and sophisticated charting. Most of these tools are built in as part of CMC’s free software platform.

Disadvantages of Using CMC

Risk to Inexperienced Users

On the other hand, the advanced flexibility and leveraging possibilities of CMC’s platform could also combine with their “anybody can use our product” simplicity as a liability. If inexperienced consumers try their hand at trading and take advantage of the heavy leveraging, they could find themselves in more trouble than they understand. Still, this is an unavoidable danger of providing cutting-edge, sophisticated financial products while also making trading available to the retail market.

Limitations in the US

Unfortunately, one of the greatest weaknesses of the company is the fact that they do not have offices in the US and that only those in the UK or Ireland can open spread betting accounts.

Establishing an Account

The application process is delightfully easy, with complete application online, nothing to print and nothing to send in. It only takes a short time to fill out the required online forms and establish an account. Payment can be made to the account via credit and debit cards, bank transfer, or by sending a check.

Summary

All in all, this is an excellent company that reaches out to customers on all levels of skill and experience. Not only have they made huge investments in their platform, but they have also made a complex process seem simple by providing all the information someone might need to use their products. American consumers interested in this type of trading can only wish that the full range of CMC Group’s products were available in the US.

CMC Forex

About CMC Group

In 1989, CMC Group was founded by Peter Cruddas in the UK as “Currency Management Corporation”—a Foreign Exchange market maker. In 1996, the company offered one of the earliest real-time forex trading platforms on the internet. CMC Group also began offering Contracts for Difference (CFDs) in 2000 and online spread betting in 2001. CMC largely defined how these products have been delivered to the retail market by offering them on the internet. CFDs and online spread betting are the core of CMC Group’s business today.

Plans for an IPO were scuttled in 2006 because of market conditions, but Goldman Sachs bought a 10% stake in the company in 2007. Profits declined in 2009 with the Global Financial Crisis, resulting in the closing of seven offices. CDC Group currently operates offices around the world, but not in the US due to regulations on CFDs and spread betting. They continue to be one of the largest global providers of these products with a little over 1,000 employees and annual revenue of £193 million. Though they are based in London, with the acquisition of the stock broker “Andrew West” in 2008, the company also conducts significant business in Australia. As members of that stock exchange (ASX), CMC allows Australians to purchase ASX-listed equities.

Key Registrations

- CMC is registered with the Australian Stock Exchange (ASX).

- CMC is regulated by the Financial Services Authority in the UK (FSA).

Vital Trading Information About CitiFX Pro

CitiFX Pro allows trading in more than 130 currency pairs, including many emerging markets that other brokerages do not allow.

Platform

CitiFX Pro uses a proprietary software—CitiFX Pro Desktop, Web or Mobile. This platform has free streaming news and data. You will also find one-click execution and a wide range of other execution tools. The CitiFX Pro platform also includes broad charting capabilities.

CitiFX Pro also offers mobile trading on cell phones or other devices. One great feature—the software is ported to the Blackberry and iPhone. This allows traders to monitor their positions in real-time, 24-hour streaming. It also offers electronic alerts if margin usage approaches key levels.

Many users find the CitiFX Pro software to be unintuitive and challenging to use. In general, this software is not the best choice for beginning forex traders and is designed with the high-end trader in mind.

Minimum Deposit Amounts

CitiFX Pro may have one of the highest opening deposit requirements—$10,000. This is just one other way that CitiFX Pro is clearly intended for advanced traders and institutions. You can make this deposit by wire.

One advantage comes from the fact that Citi is also a bank. All dollar amounts held in CitiFX Pro accounts are FDIC insured up to the normal $250,000. This is a very unusual feature in forex brokerages.

Account Set-Up

- CitiFX Pro does not offer the easiest registration. Though online application is possible, users are still asked to print it to complete their application packet. The process is also much longer than other forex brokerages.

- CitiFX Pro explicitly states that their software and service are intended for institutions, professionals, and experienced traders. CitiFX Pro does not provide basic education to beginning users. This focus on advanced users is also clear from the fact that CitiFX Pro requires such a large deposit.

- CitiFX Pro does offer three basic tutorials to guide you through setting up your account. These tutorials are sufficient, but more information would be helpful.

Demo Accounts

CitiFX Pro does not offer trial or practice accounts like other brokerages. Of course, opening an account is free with a deposit, but there is no trial or learning phase available.

Dealing Desk

Citi does not promise that it will not deal against its customers, but CitiFX Pro strongly emphasizes their effort to follow fair trading practices. As a regulated bank with audit and regulatory compliance, traders can legitimately feel somewhat more confident dealing with Citi.

Leverage Limits

The maximum leverage for CitiFX Pro is 50:1—in other words, up to 50 times the equity value. Therefore, a $10,000 opening deposit could allow you to open trades of up to $500,000.

Trailing Stops

CitiFX Pro does support trailing stops.

Trading Spreads

CitiFX Pro’s spreads are typically fairly wide, averaging two to 4 pips in normal market conditions. In more volatile markets, the spread can widen quite a bit. The wideness of CitiFX Pro’s spreads is one disadvantage of the service.

Other Features

CitiFX Pro also includes access to Citi’s FX market commentary—a significant value considering the size of Citigroup.

One other benefit based on Citi’s size is the confidence that traders can have of Citi’s fair pricing. Citi guarantees that all clients are priced the same way—based on the market.

The Bottom Line

CitiFX Pro offers excellent trading for institutions or advanced traders. The software is sophisticated and allows the functionality that advanced traders desire. But don’t expect simplicity or ease of use with CitiFX Pro. If you are a beginner or even intermediate trader, CitiFX Pro is probably not for you. Even for the most advanced, expect to find solid functionality, but nothing easy, innovative or fun to use. The greatest advantage of CitiFX Pro is the connections you have to Citigroup’s massive financial infrastructure. This is evident in several areas: You will be able to trade in more currencies, you will have access to Citi’s financial commentary and information, you will enjoy FDIC protection, and you can expect excellent customer service. In short, CitiFX Pro may be perfect for your needs if you don’t mind overcoming a software learning curve, if you have a long background with FX trading, and if you have a very large opening deposit. For anyone else, one of the smaller forex trading brokerages will probably fit you much better.

CitiFX Pro

About CitiFX Pro

Quite simply, CitiFX Pro is part of Citigroup—the huge conglomerate that began in 1812 and became one of the largest American banks by 1895. Citigroup began offering online forex trading in 2007, by joining forces with Saxo Bank and offering their software as an adaptation of Saxo Trader. CitiFX Pro is still supported by Saxo Bank in conjunction with Citi. CitiFX Pro added mobile trading in 2009. Compared to some of the other forex traders, CitiFX Pro is very much a newcomer. But the size and history of Citigroup more than make up for the newness of CitiFX Pro.

Key Registrations

As a bank, Citi is in its own category. It is not always clear what registrations CitiFX Pro uses through its connection to Citi, but quite feasibly it could use all of Citigroup’s registrations, which are practically universal. This is one reason that CitiFX Pro can offer more currency pairs than its competitors.

Vital Trading Information About Ava FX

Trading on Ava FX centers around its custom trading platform, AvaTrader. Like many other online foreign exchange programs, Ava FX’s AvaTrader features a user-friendly interface and is free for current Ava FX customers to download and use. Live streaming prices allow traders to quickly and easily make the moves they need to make. Multiple worksheets can be opened at once, increasing the ease-of-use and flexibility of the AvaTrader program. One-click trading, easy-to-read charts, simple lists for open positions and orders, user-friendly dealing rates tables – and many other great features – are all available on the AvaTrader platform.

Ava FX also offers mobile trading to those who wish to manage their foreign exchange trades via their cell phone or other mobile device.

There’s more to Ava FX than its software, which is why we take a closer look at several key characteristics of the service below.

Minimum Deposit Amounts

At $100, Ava FX has one of the higher minimum deposit amounts among top foreign exchange market brokers. Still, it is more than enough to get the ball rolling and those funds will be used in short order to engage in foreign exchange trading.

Account Set-Up

By applying online, you can set up an account with Ava FX in a relatively short amount of time. The application itself typically only takes three to five minutes to complete. From there, it takes another few days to have your application approved. An email is sent when your account is all set and ready to go; an initial deposit is, of course, required.

Demo Accounts

For up to 21 days, you can sign up for a free practice account with Ava FX. With your free account, you will be given a balance of $100,000 in fake currency so that you can get a real sense for how Ava FX and the AvaTrader software works. For best results, traders are advised to use their practice accounts for the full trial period in order to see how fluctuations and other events affect their positions.

Dealing Desk

There is no express or implied guarantees or promises made by Ava FX regarding dealing desks and trading against its customers. For that reason, traders are advised to participate at their own risk. However, this advice holds true for all foreign exchange market brokers and in no way suggests that Ava FX is inferior.

Leverage Limits

Leverage limits of up to 200:1, or up to 200 times the current equity value, are par for the course with Ava FX. With a $500 deposit, then, you could open trades of up to $100,000 with this broker.

Trailing Stops

Ava FX does support the use of trailing stops, and they are easy to set up using AvaTrader. On an existing trade, traders simply need to edit the trailing stops option within the “Open Positions” window. Otherwise, you just need to enter a stop order, click on the “Trailing Stop” option and specify the number of pips from high or low that you desire.

Trading Spreads

During normal market conditions, Ava FX offers spreads of three to four pips on major currency combinations. For example, the spread for EUR/USD is typically three pips; the spread for USD/CAD is typically five pips.

AVA FX

About Ava FX

In terms of longevity, Ava FX has not been around for a very long time. It was founded in 2006, but has already managed to secure more than 100,000 customers during its brief history. Ava FX is incorporated in Ireland, and its operations revolve around its unique software, Metatrader 4. Although Ava FX is small when compared to many other foreign exchange market brokers, its reputation is enhanced by the fact that it is backed by a major financial institution. That financial institution has been given an “A+” rating by an S & P-affiliated rating agency.

Ava FX doesn’t boast a large number of branches spread across the globe. Instead, it is made up of two basic entities: the Ava Group and Ava Capital Markets Ltd. Of course, location is not of primary concern when it comes to trading on the foreign exchange market online, and Ava FX makes up for its small size by offering a high level of customer service and support.

Key Registrations

Unlike many of the top forex brokers doing business today, Ava FX does not appear to have a large number of key registrations. Instead, it is listed as “compliant” with the Markets in Financial Instruments Directive, or MiFiD, and is regulated by the Irish Financial Regulator.

Vital Trading Information About ACM Forex

Although ACM Forex offers several different trading platforms to its customers, none of them offer the intuitive and user-friendly pizazz that come along with many other popular online forex brokers. Advanced Trader, for instance, is touted as being highly customizable; many people will find that it falls far short of those big expectations, though. Web Trader allows you to access the platform online from any PC, but the confusing way that it is laid out can create problems for those who aren’t exceptionally careful. Flash Trader is available for those who prefer to use Flash applications. None of these platforms packs the same kind of wallop that many other major brokers’ software does; ACM’s trading platforms simply aren’t a strong selling point.

Beyond the software involved when trading through ACM, however, there are many other important things that you’ll need to know. They are outlined for your convenience below.

Minimum Deposit Amounts

Only serious forex traders are going to want to sign up for a full-fledged account with ACM, because the minimum deposit here is $2,000. This isn’t an insignificant amount for most people, and will probably be prohibitively expensive for many.

Account Set-Up

Due to some sort of strict Swiss regulations and laws, it is impossible to sign up completely through the ACM website. Instead, part of the process can be performed digitally – but hard copies of the signed paperwork must be mailed away. The process is, therefore, quite cumbersome and it really stands out in the lightning-quick world of online foreign exchange market trading.

Demo Accounts

Practice accounts at ACM are free and start off with a balance of $100,000. They offer all of the same capabilities as real, live accounts and are a great way to get to know the ropes at ACM. It is strongly recommended that you sign up for a free demo account to familiarize yourself with ACM and its trading platforms before depositing any real funds with them.

Dealing Desk

ACM offers no express guarantees or promises regarding trading against their own customers. Their dealing desk is fully operational and is available to assist traders as needed. However, the lack of a guarantee does make ACM compare rather unfavorably with several other major brokers.

Leverage Limits

Not surprisingly, the maximum leverage that is allowed at ACM is 100:1. This is quite standard among the major online forex brokers, but using the maximum leverage is generally not recommended. While profits can be large, losses can be huge as well.

Trailing Stops

ACM touts the fact that they offer no slippage on stop orders, which is a definite plus for many traders. Trailing stops are permitted on the ACM trading platform, so traders do not have to miss out on that important feature.

Trading Spreads

Unlike many of the other top forex brokers, ACM does not publish an extensive or easy-to-read list of its trading spreads. That point aside, it does offer an average of three pip spreads for the four most popular currency pairs. Additionally, spreads as low as 0.5 pips are available in some cases. Indeed, competitive spreads seem to be ACM’s biggest selling point and is one of the most popular reasons that experienced forex traders sign up with them.

ACM Forex

About ACM Forex

ACM, or Advanced Currency Markets, was founded in Geneva in 2002. Since then, it has opened offices around the globe and has built up a relatively solid reputation on the crowded forex playing field. As it has grown in size, however, ACM has not necessarily kept entirely abreast of new technologies and hasn’t exactly taken full advantage of the possibilities of the Internet. Still, it is a broker that is known to be quite reliable – especially among seasoned foreign exchange market traders.

In addition to its headquarters in Geneva, ACM has branch offices in New York City, Montevideo, Zurich and Dubai. This gives ACM a fairly strong global reach and allows it to accommodate traders from many different corners of the world. Because its headquarters are in Geneva, though, the vast majority of its customer service and administrative functions are handled there. European traders are more likely to be comfortable using ACM than American traders, or those from elsewhere in the world.

Key Registrations

ACM is compliant with several important regulatory bodies. These include:

- The Swiss Financial Market Supervisory Authority (FINMA)

- The Emirates Securities and Commodities Authority of Dubai

- Ernst & Young, through regular audits

- ISO 9001 certified

Vital Trading Information About GFS Forex

Unlike many of the other major online foreign exchange market brokers, GFS Forex does not offer its own proprietary trading platform and does not offer one for download to its clients. Instead, it supports and works with several of the most popular kinds of trading software. Assuming GFS Forex works with the software of your choice, you will find it to be quite useful. If GFS Forex does not support the software that you prefer to use, you’ll find it decidedly less advantageous to trade with GFS. Finally, if you are wholly inexperienced with trading softwares of any kind, you will have a difficult time getting going with GFS Forex.

Since GFS Forex does not offer its own trading software, the focus has to be on the services that it offers. You can get a better understanding about those services and what they mean to you by reading more below.

Minimum Deposit Amounts

In the wide world of forex brokers, GFS Forex has a rather hefty minimum deposit requirement. At $500, GFS is definitely near the top of the list when it comes to the initial investment that traders have to make in order to do business with them.

Account Set-Up

Setting up an account with GFS Forex is complicated and slow, especially when compared with most other major online forex brokers. It appears that this company hasn’t updated its application process in some time, leaving those who want to open accounts to deal with a morass of confusing screens and long wait times. Of course, you will eventually be able to open an account – getting there just isn’t easy.

Demo Accounts

Demo accounts are par for the course with forex brokers nowadays, and GFS Forex is no exception. There is a free demo or practice account available that allows you to get a feel for how GFS Forex and its system works. However, you’re going to have to do a lot of digging to find out how to make this happen – the site is not exactly forthcoming with the information.

Dealing Desk

Generally companies that do not have a dealing desk typically market that heavily. No mention whatsoever is made of dealing desks at GFS Forex. They make no guarantees or promises about using or relying on dealing desks, and there is no definite way to tell whether or not they trade against their clients. Additionally, there does not appear to be any sort of special accommodations made for registered clients; everyone shares the same customer service features, regardless of whether they are paying customers or not.

Leverage Limits

Leverage limits at GFS Forex are pretty standard and are either 1:100 or 1:200. These limits are not unusual and can be found at other brokers all over the Internet, so in this way GFS Forex does conform with what the majority of its peers are doing.

Trailing Stops

Not surprisingly, trailing stops are allowed and encouraged at GFS Forex. This is one concession that GFS makes to its traders in order to help them minimize their overall risk on the foreign exchange market.

Trading Spreads

While many online foreign exchange market brokers offer unique perks or ultra-slim spreads to lure traders in, GFS Forex does not. Instead, even on a popular currency pair like EUR/USD, it offers an average spread of three pips. A tiny bit of research will show you that there are much more competitive spreads to be found elsewhere.

GFS Forex

About GFS Forex

When it was first founded in 2001, GFS worked with various investment instruments and provided a broad suite of investment services. It wasn’t until 2006 that GFS Forex & Futures, Inc., began to delve into the foreign exchange market in earnest. Initially, this broker did not accept clients from the United States – a move that seriously limited its growth potential. However, GFS eventually did open its doors to U.S. traders and has since seen its business boom considerably.

From its headquarters in San Francisco, GFS Forex now focuses on providing foreign exchange market traders with professional and efficient trading tools. An additional branch, in New York City, is located near Wall Street and helps keep this broker in the loop when it comes to financial news. In this way, serious investors and traders can take heart in the fact that GFS Forex is a legitimate financial trading operation.

Key Registrations

Since it operates on United States soil, GFS Forex does maintain compliance with several regulatory bodies. For example:

- GFS Forex is a Registered Futures Commission Merchant (FCM) with the Commodity Futures Trading Commission (CFTC)

- GFS Forex is a member of the National Futures Association (NFA)

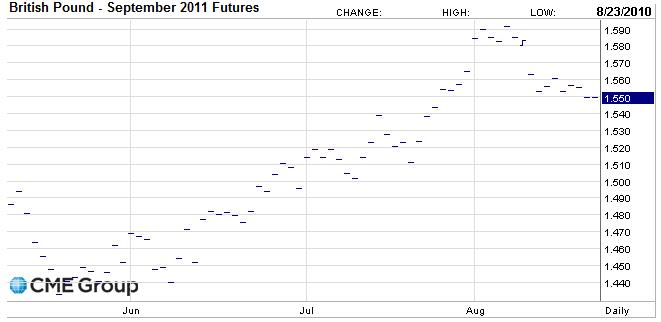

The rally in the Pound, which lifted it 10% from trough to peak, appears to be fizzling. The Pound is already down 3% in the last two weeks, and is trending downward. It now stands at a four-week low against the Dollar.

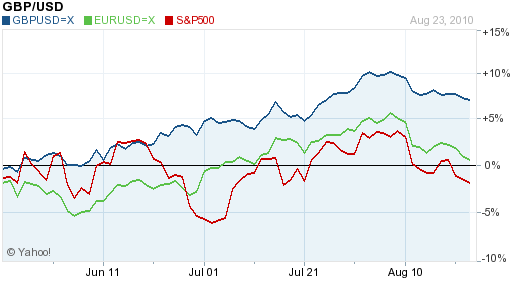

Looking back at the Pound’s two-month rise, it’s not hard to understand why it was unsustainable. You can see from the charts below that there was a strong correlation with the Euro and the S&P 500 over the same period of time. This suggests that the Pound rally was less a product of changing fundamentals and more due to a sudden decrease in risk aversion.

By no coincidence the rally in equities, the Euro, and a handful of other proxy vehicles for risk, all came to and end at the same time as the Pound. In a nutshell, the markets are back to focusing on fundamentals. Namely, the risk of a double-dip recession, combined with a lack of resolution in the Eurozone debt crisis is causing investors to think twice about making bets that entail any kind of risk.

In this regard, the Pound is especially vulnerable. On the economic front, the UK economy only grew by 1.1% in the second quarter, with economists predicting only modest growth for the year. According to an economist for the Bank of England, “It would be ‘foolish’ to rule out a renewed downturn.” Evidently, his bosses agree: “The Bank of England last week said growth will be weaker than it forecast in May, citing “continuing fiscal consolidation and the persistence of tight credit conditions.”According to a recent poll, almost half of British households are pessimistic about the country’s economic prospects in the near-term: “The proportion of pessimists is marginally lower than in July, but is higher than in any other month since March last year.”

Ironically, the efforts of the British government to curb spending and cut the deficit are perceived as making matters worse. Since these measures won’t be offset by lowered taxes, they will directly lead to lower economic growth. Given that both the Pound and UK bond prices are rising (implying an increased risk of default), I think this reinforces the point I made last week about the markets not caring at all in this economic climate about increasing national debt.

The icing on the cake is inflation. A British think-tank made headlines by predicting that the UK economy will emerge from recession next year, “But once recovery is under way, he thinks, then the Bank of England’s quantitative easing scheme, which pumped £200 billion into the economy in the wake of the credit crunch, will have terrible consequences.” Specifically, the think-tank is forecasting inflation of 10% and a benchmark interest rate of 10%.

For now, this remains a distant prospect, and analysts are focusing on the fact that the economy will probably re-enter recession before it can officially exit from it. As for the Pound, forecasts are not optimistic: “Bears in a Bloomberg survey of strategists outnumber bulls 29 to 12, while TD Securities in Toronto, the most-accurate forecaster in the six quarters ended June 30, has the lowest estimate, predicting sterling will depreciate 15 percent versus the dollar by year-end.” According to the most recent Commitments of Traders report, institutional investors were still net long the Pound as of August 10. Futures prices, meanwhile, have moved in lockstep with spot prices, which suggests that futures traders are still waiting for more data before they weigh in on the Pound.

Personally, I’m having a tough time coming up with a prediction. I tend to agree with the characterization of “the foreign exchange markets post-crisis as a beauty parade with ugly contestants.” In other words, all of the major currencies are currently plagued by poor fundamentals. It’s hard to say that the Pound is in better or worse shape than the Dollar or the Euro. Still, given the way that markets have been trading, a return to (global) recession would not be kind to the Pound.

FOREX IS AN ART

In that sense, we must take forex as an art and not a science. I know, some people may not agree with me and all the post that is in this blog. I don't blame them coz I was actually in the same place as they were when I started trading. Trying to find the answer to forex using every logical explanation.

This is the answer that you have been looking for. I am going to give it to you straight away. Let see if your mind can accept it.

Forex is not a science. There is not a single mathematical equation that can explain it. Do not forecast, do not predict, do not anticipate. All you need to do to make profit is to follow the market. If the price is going up, you buy. If the price is going down, u sell. You may not win all the time but if you follow the market, in the end you will be in profit. Make profit and build up your capital up to a point where a few winning trades per month will bring huge profit.

USD/EUR Details

USD/EUR for the 24-hour period ending Wednesday, December 15, 2010 22:00 UTC @ +/- 0%

| Selling 1.00000 USD | | you get 0.75038 EUR |

| Buying 1.00000 USD | | you pay 0.75045 EUR |

Rate Details

USD/EUR for the 24-hour period ending

Wednesday, December 15, 2010 22:00 UTC

| Bid Sell 1 USD | Ask Buy 1 USD | |||

|---|---|---|---|---|

| MIN | 0.74694 | 0.74704 | ||

| AVG | 0.75038 | 0.75045 | ||

| MAX | 0.75691 | 0.75698 |

These values represent the daily average of the Bid and Ask rates OANDA receives from many data sources.

Today Forex Rates

EUR/USD +0.561 %

CAD/USD -0.115 %

JPY/USD +0.787 %

AUD/USD +0.584 %

GBP/USD +1.065 %

GBP/EUR +0.501 %

JPY/EUR +0.224 %

GBP/AUD +0.478 %

JPY/AUD +0.201 %

USD USD |  GBP GBP |  CAD CAD |  EUR EUR |  AUD AUD | |

| 1 | 1.56642 | 0.994045 | 1.33599 | 0.994342 |

| 0.638398 | 1 | 0.634596 | 0.852899 | 0.634786 |

| 1.00599 | 1.5758 | 1 | 1.344 | 1.00029 |

| 0.748503 | 1.17247 | 0.744046 | 1 | 0.744268 |

| 1.00569 | 1.57533 | 0.999701 | 1.3436 | 1 |